The UK is witnessing a silent healthcare shift as NHS dermatology wait times have surged significantly since 2019. Every month, thousands of Britons bypass lengthy NHS queues to pay for private mole removals, cyst excisions, and skin cancer checks; procedures once routinely handled by public healthcare. This data-driven analysis examines the statistics behind this growing trend.

- Dr Sharon Crichlow

- Reading Time: 10 Mins

Key Statistics at a Glance

- NHS dermatology waiting lists grew by 82% between April 2021 and March 2024, showing rising pressure on skin services.

- As of February 2025, only 59% of elective patients received treatment within 18 weeks, far below the 92% NHS target.

- Melanoma cases have risen nearly 30% in the past decade, with a projected record 20,800 new cases in 2024, underlining the urgency for timely evaluation and removal.

- Over 1.1 million private diagnostic scans and tests took place in 2024, signalling strong demand for faster skin assessments.

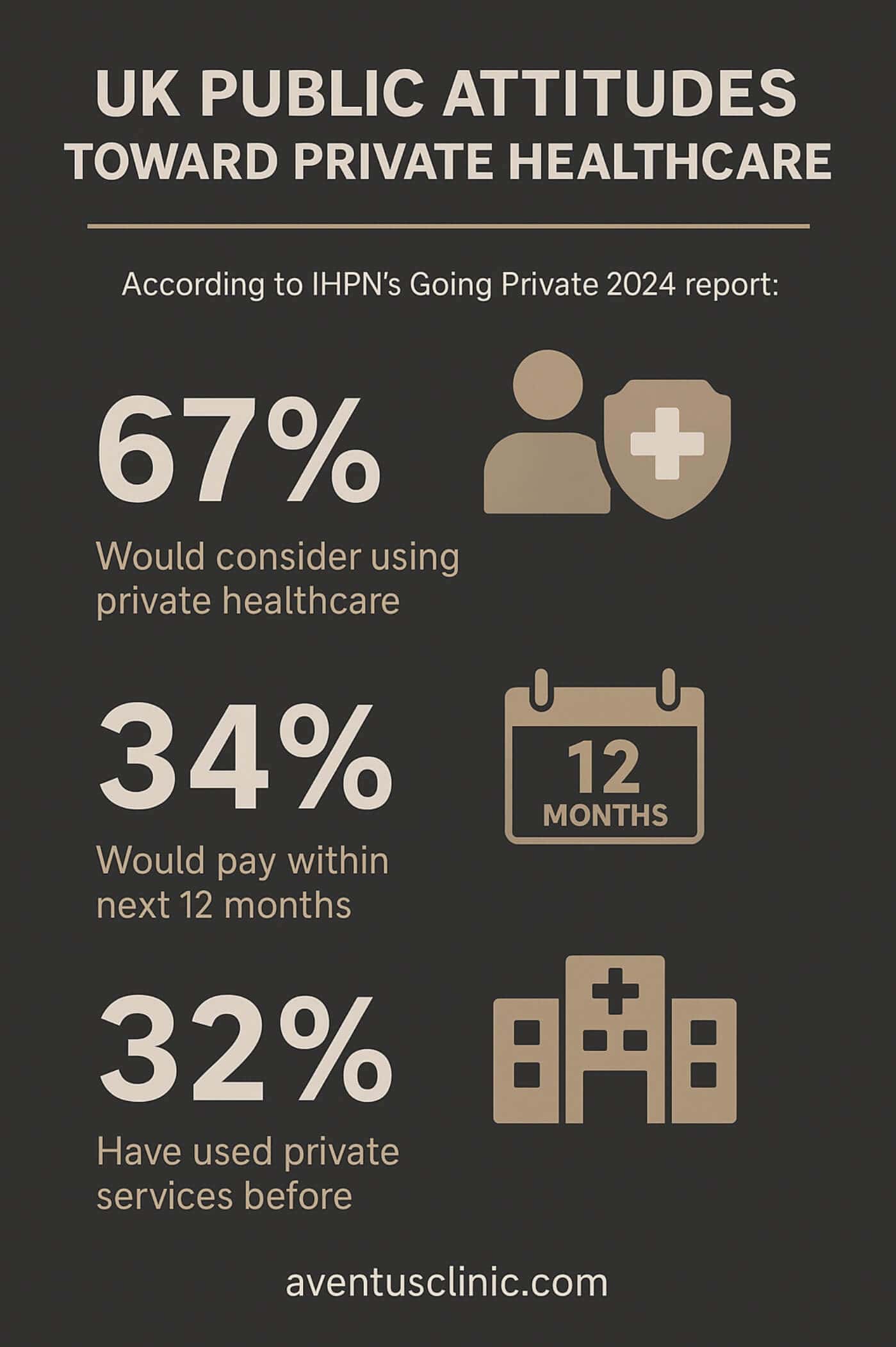

- Public appetite for private care is high: 67% of adults say they would consider using private healthcare if needed.

- NHS policies now stop routine funding for benign skin lesion removal unless classified as “medically necessary.”

- Private mole removals typically range from £300 to £900+ per lesion, depending on technique and pathology.

Table of Contents

UK Skin Condition Prevalence

Skin disorders represent a significant public health concern in Britain, with both cancerous and benign conditions driving demand for dermatological services.

Melanoma incidence continues to rise, with approximately 17,500 new cases diagnosed annually between 2017-2019, making it the UK’s fifth most common cancer. More concerning still, Cancer Research UK projects a 9% increase in melanoma rates between 2023-2025 and 2038-2040, potentially reaching 33 cases per 100,000 population.

Non-melanoma skin cancers occur at even higher rates, with about 155,985 new cases and 918 deaths annually. These statistics partly explain the high volume of urgent dermatology referrals.

Benign conditions also contribute significantly to dermatology demand:

| Condition | Prevalence | Demographic Pattern |

|---|---|---|

| Lipomas (benign fatty tumours) | Affects approximately 1% of the population | More common in people aged 40-60 |

| Sebaceous / epidermal cysts | The most common type of skin cyst | Typically occurs between ages 20-60, more common in men |

| Moles requiring removal | Variable, but increasing due to skin cancer awareness | All age groups, higher concern in fair-skinned populations |

These conditions often don’t threaten life but can cause discomfort, anxiety, and cosmetic concerns, driving patients toward private options when NHS care is delayed or unavailable.

NHS Dermatology Waiting Times

The waiting time crisis represents perhaps the most significant driver of private skin surgery growth.

In February 2025, only 59% of patients had been waiting less than 18 weeks to start elective treatment, far below the NHS target of 92%. For dermatology specifically, wait times across English integrated care systems ranged from 7.1 to 17.2 weeks in 2024, with only 64% of patients seen within 18 weeks.

This represents a significant deterioration from pre-pandemic levels:

| Waiting Time Indicator | Statistic | Impact |

|---|---|---|

| Increase since 2021 | 82% longer waits | Driving patients to private alternatives |

| Overall NHS waiting list | 7.4 million pathways (Jan 2025) | System-wide pressure affecting all specialities |

| Dermatology backlog | 380,000+ people waiting >18 weeks | Creating significant market for private providers |

| COVID-19 impact | ~300,000 missed first appointments | Pandemic exacerbated existing problems |

Staffing shortages compound these delays, with approximately 24% of consultant dermatologist posts (159 of 659 whole-time equivalents) unfilled. This workforce gap directly impacts appointment availability and waiting times.

NHS Funding Policies for Skin Lesions

Policy changes have further restricted NHS access for certain skin procedures, creating additional demand for private alternatives.

Most integrated care boards now follow national Evidence-Based Interventions guidance, which does not routinely fund removal of benign skin lesions (moles, cysts, lipomas) unless there is suspicion of malignancy or significant symptoms.

For example, NHS Devon explicitly states that assessment or removal of benign skin or subcutaneous lesions is not routinely commissioned, and once a lesion is confirmed as non-malignant, its removal will not normally be funded.

These restrictions represent a deliberate policy shift designed to prioritise limited NHS resources for more medically urgent cases. However, they effectively transfer costs to patients seeking removal of:

- Unsightly but benign moles

- Lipomas causing mild discomfort

- Sebaceous cysts without infection

- Other non-malignant skin growths

Private Skin Surgery Market

The private dermatology in the UK is expanding rapidly to meet growing demand. In 2024, cosmetic surgeries rose by 5% compared to 2023, with 27,462 procedures performed.

Procedure costs vary by complexity and clinic location:

| Procedure | Price Range (2024-2025) | What's Typically Included |

|---|---|---|

| Mole removal | £295-£840 per lesion | Consultation, local anaesthetic, removal, histology |

| Sebaceous cyst removal | £300-£1,500 | 30-min procedure with local anaesthetic |

| Lipoma removal | £475-£2,275 | Cost varies by size and location |

These prices, while significant, are comparable to other discretionary spending, such as dental work or short holidays, making them affordable for many working professionals seeking faster treatment.

Most clinics emphasise same-day consultation and treatment, with histological testing typically included for removed moles, a stark contrast to NHS pathways that can involve multiple appointments across several months.

Patient Motivations and Demographics

Public attitudes toward private healthcare in the UK are shifting significantly.

The main reasons? Delays and difficulty accessing NHS services, especially among younger groups, and increasing workplace access to private health benefits.

YouGov data reinforces these trends: 1 in 8 used private care in the past year; for 53%, the key factor was speed of access.

In short, faster appointments, normalised private options, and growing demographic receptivity are fueling demand for private healthcare across the UK.

These motivations reflect both “push” factors (NHS limitations) and “pull” factors (perceived benefits of private care).

Health Equity Implications

The shift toward private skin surgery raises important equity concerns.

While private options provide timely access for those who can afford it, they potentially widen healthcare disparities. A “Doctors for the NHS” survey found that 98%, almost all, of frontline staff worried long waits would lead to poorer health outcomes, particularly for those unable to pay privately.

The same survey revealed that 20% of patients were advised by NHS staff themselves to seek private care, highlighting ethical tensions within the system.

Regional disparities compound these concerns. The Sanofi heatmap showed that some regions have as few as 0.56 dermatologists per 100,000 people, while others have 4.91 per 100,000. This “postcode lottery” means patients in underserved areas face both longer NHS waits and potentially greater travel distances for private alternatives.

Improving Skin Healthcare Access

Addressing the growing reliance on private skin surgery requires multi-faceted approaches.

Workforce development represents the most urgent need, with nearly one-quarter of consultant dermatologist positions unfilled. Training and retaining specialists could significantly reduce waiting times.

Technological innovations offer additional pathways:

- Teledermatology could improve efficiency, with global implementations reducing waits to 1.9 days average access

- AI-assisted diagnostics may help prioritise urgent cases more effectively

- Digital monitoring tools could reduce unnecessary follow-up appointments

Policy considerations might include:

- Reassessing funding restrictions for benign lesions that cause psychological distress

- Developing clearer clinical thresholds for NHS treatment eligibility

- Establishing public-private partnerships to reduce backlogs

Conclusion

With melanoma rates projected to continue rising and two-thirds of adults now willing to consider private care, this trend shows no signs of reversing without substantial NHS reforms. While private options provide faster access for those who can afford £300-£800 procedures, they risk deepening health inequities for those who cannot.

Addressing these challenges requires not only increased dermatology capacity but also thoughtful policy approaches that balance resource constraints with equitable access to skin healthcare for all Britons.

- Sources

- https://www.cancerresearchuk.org/

- https://melanomafocus.org/

- https://www.theguardian.com/

- http://wcrf.org/preventing-cancer/

- https://www.carnallfarrar.com/

- https://southwest.devonformularyguidance.nhs.uk/

- https://baaps.org.uk/about/news/

- https://yougov.co.uk/health/

- https://doctorsforthenhs.org.uk/

- https://www.sanofi.co.uk/